- Home

- Marketplace

- Start-up Suite

Get a startup loan the smart way

- Startup Loans with competitive rates and flexible terms

- Compare your startup loan options from specialist providers using our Smart Search technology.

- 24/7 Support, with experts on hand when you need them

Scan the QR code to download the App

Download the App

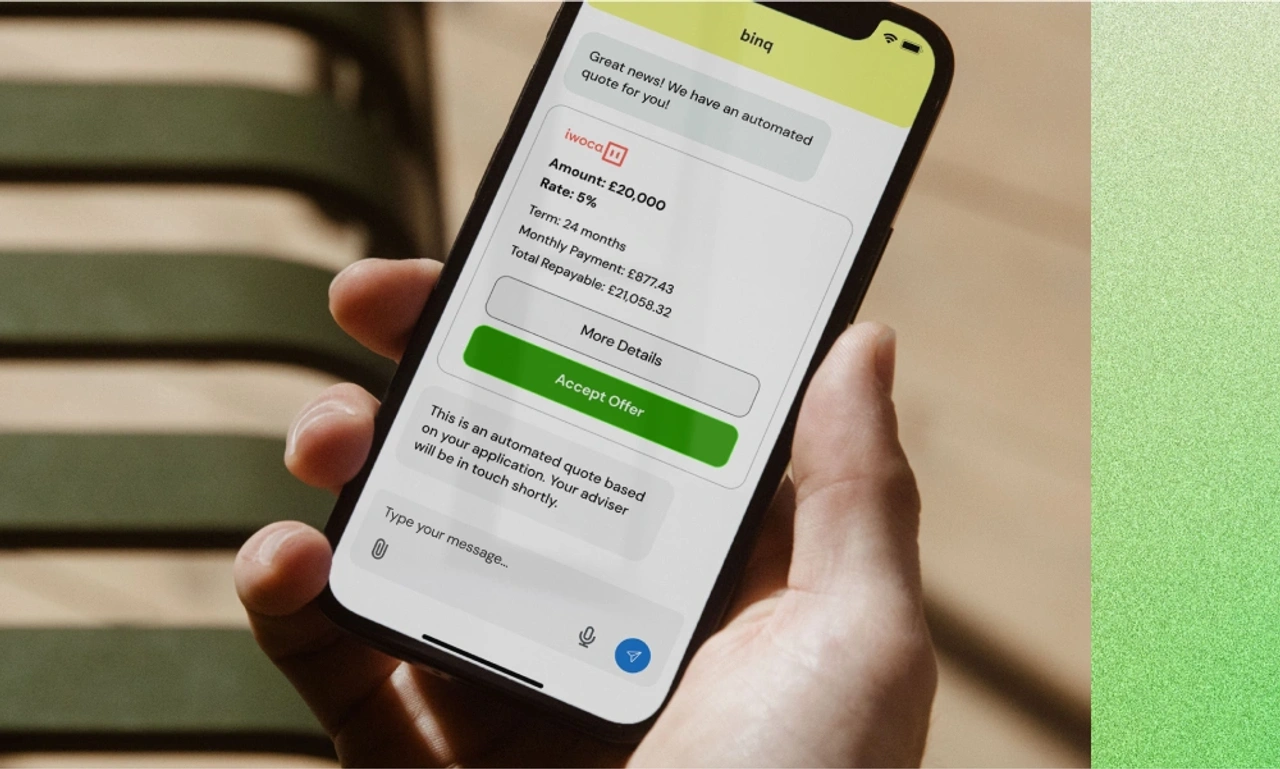

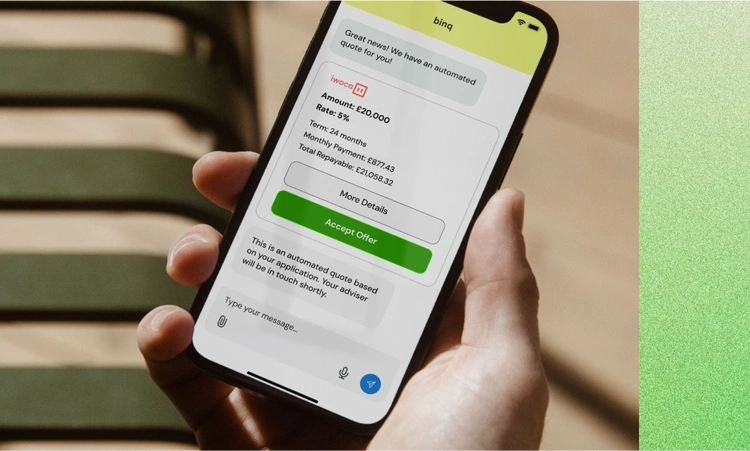

Get matched to your best loan options in minutes

Speak with one of our experts, and get 24/7 support from your personal AI business advisor.

- Upload your documents

- Track your progress

- Apply with confidence Compare loans

The different types of startup loans

Unsecured business loans

No collateral needed - get funding based on your business plan and personal credit. Quick decisions and flexible terms, though interest rates may be higher than secured options.

Secured business loans

Use property or assets as security to get better rates and larger amounts. Lower interest costs but your assets are at risk if you can't repay.

Asset finance

Buy equipment, vehicles, or machinery and use them as security. Spread the cost over time while building your business with the tools you need.

Invoice finance

Get money against future sales or outstanding invoices. Great for service businesses or those with confirmed contracts but need cash up front.

Government startup loans

Get up to £25,000 with competitive rates and mentoring support. Backed by the government with fixed interest rates and no early repayment fees. Perfect for new businesses under 24 months old.

Peer-to-peer loans

Borrow directly from investors through online platforms. Often faster approval and more flexible terms than traditional banks.

Fund your startup in a way which works for your business.

Personalised and flexible options to help you launch faster, manage cash flow, buy essential equipment, or bridge the gap until revenue kicks in.

- Smart searches and easy applications

- Loans tailored to your startup needs

- Competitive rates with flexible repayment terms