- Home

- Marketplace

- Business Insurance

Business insurance for more than 1,000 business types

Quotes to suit your business, and the level of cover you need.

Tailored cover from market-leading insurers

Public Liability Insurance

- Get a quote in minutes

- Up to £5 million cover

Public Liability Insurance

- Get a quote in minutes

- Up to £5 million cover

Who needs it?

This is designed to protect your business if a customer or member of the public is injured, or if their property is damaged because of your work. Public liability insurance could cover compensation claims against you, legal costs, and medical expenses.

Employers’ liability insurance

- £10 million cover as standard

- Legally required for most employers in the UK

Employers’ liability insurance

- £10 million cover as standard

- Legally required for most employers in the UK

Who needs it?

If one of your employees is injured or becomes ill because of their work, employers’ liability insurance can cover you against compensation, legal fees, and medical costs. In most circumstances, employers’ liability is a legal requirement.

Business equipment and tools insurance

- Cover forcible theft, loss, and damage

- Tweak your policy anytime, without fees

Business equipment and tools insurance

- Cover forcible theft, loss, and damage

- Tweak your policy anytime, without fees

Who needs it?

This cover could help with the cost of replacing or repairing your portable electronics, machinery, specialist equipment, and tools if they’re forcibly stolen, lost, or accidentally damaged.

Business interruption insurance

- Protection for the unexpected

- UK-based claims support

Business interruption insurance

- Protection for the unexpected

- UK-based claims support

Who needs it?

If something unexpected puts your business on pause, business interruption cover can help protect your income. It can support you to keep things moving while you get back on your feet.

Building and contents insurance

- Cover forcible theft, loss, and damage

- Get protected in minutes

Building and contents insurance

- Cover forcible theft, loss, and damage

- Get protected in minutes

Who needs it?

Designed to cover the building you operate from and the contents inside, including stock in case of forcible theft, damage, or destruction.

Accident and sickness insurance

- For employees aged 16–19

- No medicals required

Accident and sickness insurance

- For employees aged 16–19

- No medicals required

Who needs it?

If you or your employees can’t work due to injury or illness, accident and sickness cover could pay a regular income to cover expenses, helping to maintain business operations.

Once you’ve completed your quote, download and review the summary of your cover to make sure it’s right for your business. You should always refer to your policy documents for full details around exclusions, terms and limits of your customised cover.

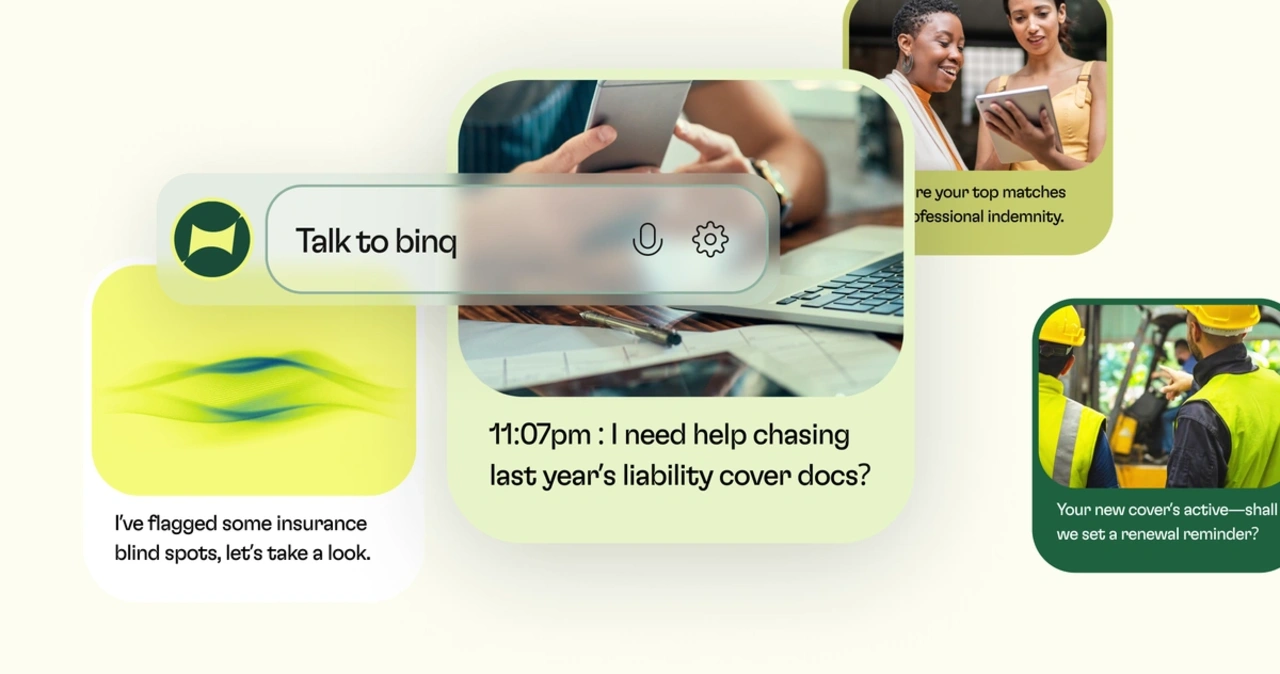

Your search is SUPERCHARGED

Powered by Superscript, get business insurance to cover more than 1,000 business types.

- Pricematch guarantee

- FCA authorised

- UK based customer support

FAQs

If you have employees, employers’ liability insurance is likely the only type of cover you’re legally required to have. But legalities aside, there are other good reasons to consider insurance. You might decide that not being covered leaves you open to risks that are simply too costly to ignore.

Insurance can help to protect your business from surprise costs and expenses which could affect your business, helping you stay in control when things go wrong.

So that you get the most suitable type of insurance and level of cover, you’ll need to prepare all the relevant information about your business. This might include details about the number of people you employ, the industry you’re in, and any previous claims you've made.

The amount you pay will depend on various factors, such as the size of your business, the industry you’re in, and the level of insurance coverage you need.

Double-check that all your details are accurate and up to date – it helps make sure your quote’s spot on.

You can get covered in minutes – from quote to policy in just a few clicks. Simple policies will usually start as soon as you’ve completed the application and paid the premium. If the agreement is more complicated, it might take a few days or weeks to process.

We’ve partnered with digital insurance broker, Superscript, who have a UK-based in-house claims team to support you if you need to make a claim. Rated ‘excellent’ on Trustpilot, all the info you need to make a claim is included in your quote and policy documents.

If you’re running a business from home, you’ll likely need separate business insurance, as personal insurance won’t cover you. This will be for things like equipment, liability claims, and any professional risks.

Public liability insurance is designed to cover claims if someone says your work caused them injury or damaged their property.

Professional indemnity insurance is designed to cover the cost if a mistake in your work or advice leads to a client losing money.

Yes. Along with other allowable expenses, business insurance is tax-deductible, helping you to reduce the amount of tax you need to pay each year.

Absolutely – you can update or tweak your cover whenever your business hires more staff, you make changes to your services, or move premises. We’ve partnered with digital insurance broker, Superscript, who offer fee-free policy adjustments.